Home sales dip in Waterloo Region

August was a soft month for home sales in Waterloo Region.

New statistics released by the Waterloo Region Association of Realtors (WRAR) show there were 568 homes sold last month, which represents a 14.2 per cent decrease compared to August 2022.

The association said it’s the first time August sales dipped below the 600-unit mark.

“Home sales were softer than normal last month, which is not surprising given the current borrowing environment,” Megan Bell, president of WRAR, said in a news release.

Local real estate agent Tony Johal said the Bank of Canada’s fixed interest rate announcement on Wednesday is a good decision, which could help the industry.

“A lot of people do enter the market in the fall with the intention of closing by the end of the year. You don’t want to discourage people getting into the real estate market, there’s a lot of inventory out there for them to pick from, so I think it’s a smart move,” Johal said.

Although overall home sales were down in the region compared to last year, the number of condominiums sold was up by 10.4 per cent and townhouse sales were up 12.6 per cent.

“Simply because many people bought these townhouses two years ago or three years ago. Now, all of a sudden they’re closing and they just got the keys and things have changed financially for a lot of people,” Johal said.

(Waterloo Region Association of Realtors)

(Waterloo Region Association of Realtors)

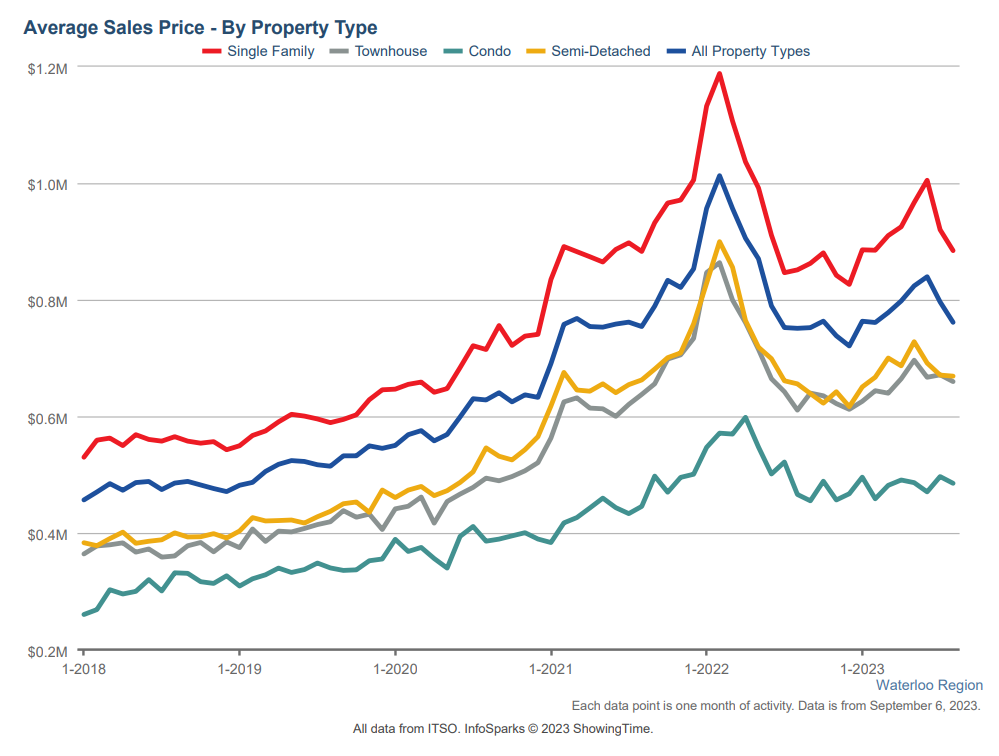

The average sale price was recorded at $761,377. That’s a 1.4 per cent increase compared to August of last year, and a 4.4 per cent decrease compared to July.

The association said there was strong listing activity in August, helping to increase choice and soften prices.

New listings were up 9.7 per cent compared to last August and 11.7 per cent compared to the ten-year average for August.

Mortgage broker and co-founder of ratefilter.ca Andy Hill said many homeowners who are locked into a fix rate mortgage are refraining from selling right now.

He said although the Bank of Canada’s fixed interest rate could be the first step to potentially seeing relief, many are still struggling.

“It’s a tough time, especially for new homeowners that bought during the pandemic and bought on an adjustable rate mortgage,” Hill said.

“I think that this is one of those times where you’ve got to just try to buckle up and hold on in a holding pattern and hopefully things get better in the next few years.”

He said his biggest tip for anyone renewing a mortgage in the near future is to shop around to ensure you’re getting the best mortgage rate possible.

CTVNews.ca Top Stories

Canadian family stuck in Lebanon anxiously awaits flight options amid Israeli strikes

A Canadian man who is trapped in Lebanon with his family says they are anxiously waiting for seats on a flight out of the country, as a barrage of Israeli airstrikes continues.

Suspect in shooting of Toronto cop was out on bail

A 21-year-old man who was charged with attempted murder in the shooting of a Toronto police officer this week was out on bail at the time of the alleged offence, court documents obtained by CTV News Toronto show.

Scientists looked at images from space to see how fast Antarctica is turning green. Here's what they found

Parts of icy Antarctica are turning green with plant life at an alarming rate as the region is gripped by extreme heat events, according to new research, sparking concerns about the changing landscape on this vast continent.

DEVELOPING 2 dead after fire rips through historic building in Old Montreal

At least two people are dead and others are injured after a fire ripped through a century-old building near Montreal's City Hall, sources told Noovo Info.

Yazidi woman captured by ISIS rescued in Gaza after more than a decade in captivity

A 21-year-old Yazidi woman has been rescued from Gaza where she had been held captive by Hamas for years after being trafficked by ISIS.

A 6-year-old girl was kidnapped in Arkansas in 1995. Almost 30 years later, a suspect was identified

Nearly 30 years after a six-year-old girl disappeared in Western Arkansas, authorities have identified a suspect in her abduction through DNA evidence.

Dolphins 'smile' at each other when they play and to avoid misunderstanding, study finds

For humans, flashing a smile is an easy way to avoid misunderstanding. And, according to a new study, bottlenose dolphins may use a similar tactic while playing with each other.

Pit bulls in B.C. pet mauling tested positive for meth, cocaine, says city

Three pit bulls involved in a deadly attack on another dog last month in Kamloops, B.C., tested positive for methamphetamine and cocaine, and the city is going to court to have them put down.

Tax rebate: Canadians with low to modest incomes to receive payment on Friday

Canadians who are eligible for a GST/HST tax credit can expect their final payment of the year on Friday.