Here’s how variable mortgage payments have changed in K-W in 2022

Homeowners with variable mortgage rates have seen their monthly premiums increasing, and with the latest interest rate hike by the Bank of Canada, monthly mortgage payemnts will continue to rise.

On Wednesday, the Bank of Canada hiked its key policy rate by half a percentage point to 4.25 per cent– the last expected rate hike of 2022 – and a total increase of four per cent over the year.

Mortgage calculations given to CTV News Kitchener from RateHub.ca show a homeowner who put a 10 per cent down payment on a $723,200 home with a 5-year variable rate of 4.75 per cent amortized over 25 years has a monthly mortgage payment of $3,808.

The newest rate hike pushed the rate to 5.25 per cent, and increases the monthly payment by $191 since the last rate hike in October.

CHANGE OVER THE YEAR

In January of 2022, a homeowner who put a 10 per cent down payment on a $924,600 home in Kitchener-Waterloo with a 5-year variable rate of 0.90 per cent would have had a mortgage payment of $3,194 with a mortgage of $857,963.

“Wednesday’s 50-basis point rate increase the homeowner’s variable mortgage rate will increase to 4.90% and their monthly payment will increase to $4,941,” RateHub.ca said.

This means the homeowner would now be paying $1,747 more per month or $20,964 more per year on their mortgage payments, representing a 55 per cent increase.

Based on the October 2022 CREA average home price in Kitchener-Waterloo, Wednesday’s rate hike means homeowners will pay $191 more per month or $2,292 per year on their mortgage payments.

In January of 2022, a homeowner who put a 10 per cent down payment on a $924,600 home with a 5-year fixed rate of 2.39 per cent – the lowest insured 5-year fixed rate in Canada at the start of January 2022 - the amortized over 25 years would have a monthly mortgage payment of $3,796.

This is assuming the same mortgage of $857,963.

EXPERT WEIGHS IN

Mortgage advisor James Laird said the latest rate hike does have a silver lining, as the Bank of Canada will now be considering if rates need to go up further, instead of saying “rates will need to go up further.”

“The one thing I like to point out in these discussions is that everyone with a mortgage today did pass a stress test today at a rate pretty close to what they have right now,” said Laird. “So, that is the one kind of p[positive thing, is these mortgages were all underwritten to make sure the consumers could qualify for rates similar to those we are seeing in the market.

Laird said for those who have seen their mortgage rates increase, some options to help pay down the balance could mean forgoing frivolities such as eating out or vacationing, while paying down lump sum payments if possible.

“Make a lump sum payment or an additional payment. That’s obviously helpful because it goes directly to your principal. But, I also feel silly saying that as I know Canadians are strained right now, and not a lot of people have extra money just sitting around looking for someplace to go,” said Laird.

He said the one thing not to do is miss a payment, and if that may occur, the best option is to reach out to the lender and look for options.

This may include extending the amortization to lower the monthly mortgage payment, however, it does extend the life of the load.

“The lenders are being pretty accommodating right now. What’s offered to each consumer is based on the situation … they listen to what’s going on,” said Laird.

CTVNews.ca Top Stories

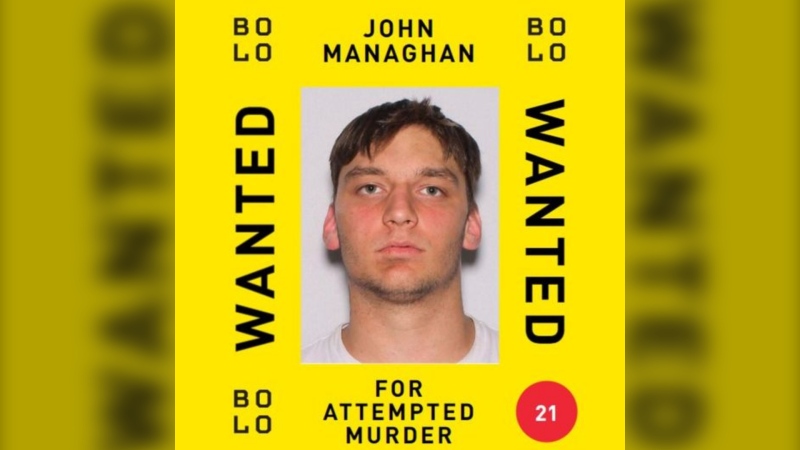

Former homicide detective explains how police will investigate shooting outside Drake's Bridle Path mansion

Footage from dozens of security cameras in the area of Drake’s Bridle Path mansion could be the key to identifying the suspect responsible for shooting and seriously injuring a security guard outside the rapper’s sprawling home early Tuesday morning, a former Toronto homicide detective says.

Federal government grants B.C.'s request to recriminalize hard drugs in public spaces

The federal government is granting British Columbia's request to recriminalize hard drugs in public spaces, nearly two weeks after the province asked to end its pilot project early over concerns of public drug use.

Stormy Daniels describes meeting Trump during occasionally graphic testimony in hush money trial

Stormy Daniels took the witness stand Tuesday at Donald Trump's hush money trial, describing for jurors a sexual encounter the porn actor says she had with him in 2006 that resulted in her being paid off to keep silent during the presidential race 10 years later.

MPs agree Canadian gov't should improve new disability benefit

The federal government needs to safeguard the incoming Canada Disability Benefit from clawbacks and do more to ensure it actually meets the stated aim of lifting people living with disabilities out of poverty, MPs from all parties agree.

Bye-bye bag fee: Calgary repeals single-use bylaw

A Calgary bylaw requiring businesses to charge a minimum bag fee and only provide single-use items when requested has officially been tossed.

CFL suspends Argos QB Chad Kelly at least nine games following investigation

The CFL has suspended Toronto Argonauts quarterback Chad Kelly for at least nine regular-season games following its investigation into a lawsuit filed by a former strength-and-conditioning coach against both the player and club.

Boy Scouts of America changing name for first time in 114 years, aiming for inclusivity

The Boy Scouts of America is changing its name for the first time in its 114-year history and will become Scouting America. It's a significant shift as the organization emerges from bankruptcy following a flood of sexual abuse claims and seeks to focus on inclusion.

opinion Tom Mulcair: Trudeau's handling of Poilievre's 'wacko' House turfing a clear sign of Liberal desperation

When Speaker Greg Fergus tossed out Pierre Poilievre from the House last week, "those of us who have experience as parliamentarians simply couldn't believe our eyes," writes former NDP leader Tom Mulcair in his column for CTVNews.ca

New charges for Ont. woman who previously admitted to defrauding doulas

The Brantford, Ont. woman who was previously sentenced to house arrest after admitting to deceiving doulas has been charged again in connection to a new victim.