Here’s how variable mortgage payments have changed in K-W in 2022

Homeowners with variable mortgage rates have seen their monthly premiums increasing, and with the latest interest rate hike by the Bank of Canada, monthly mortgage payemnts will continue to rise.

On Wednesday, the Bank of Canada hiked its key policy rate by half a percentage point to 4.25 per cent– the last expected rate hike of 2022 – and a total increase of four per cent over the year.

Mortgage calculations given to CTV News Kitchener from RateHub.ca show a homeowner who put a 10 per cent down payment on a $723,200 home with a 5-year variable rate of 4.75 per cent amortized over 25 years has a monthly mortgage payment of $3,808.

The newest rate hike pushed the rate to 5.25 per cent, and increases the monthly payment by $191 since the last rate hike in October.

CHANGE OVER THE YEAR

In January of 2022, a homeowner who put a 10 per cent down payment on a $924,600 home in Kitchener-Waterloo with a 5-year variable rate of 0.90 per cent would have had a mortgage payment of $3,194 with a mortgage of $857,963.

“Wednesday’s 50-basis point rate increase the homeowner’s variable mortgage rate will increase to 4.90% and their monthly payment will increase to $4,941,” RateHub.ca said.

This means the homeowner would now be paying $1,747 more per month or $20,964 more per year on their mortgage payments, representing a 55 per cent increase.

Based on the October 2022 CREA average home price in Kitchener-Waterloo, Wednesday’s rate hike means homeowners will pay $191 more per month or $2,292 per year on their mortgage payments.

In January of 2022, a homeowner who put a 10 per cent down payment on a $924,600 home with a 5-year fixed rate of 2.39 per cent – the lowest insured 5-year fixed rate in Canada at the start of January 2022 - the amortized over 25 years would have a monthly mortgage payment of $3,796.

This is assuming the same mortgage of $857,963.

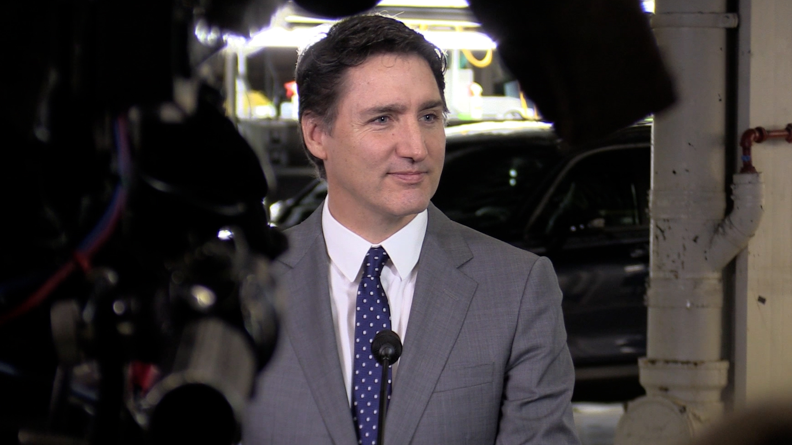

EXPERT WEIGHS IN

Mortgage advisor James Laird said the latest rate hike does have a silver lining, as the Bank of Canada will now be considering if rates need to go up further, instead of saying “rates will need to go up further.”

“The one thing I like to point out in these discussions is that everyone with a mortgage today did pass a stress test today at a rate pretty close to what they have right now,” said Laird. “So, that is the one kind of p[positive thing, is these mortgages were all underwritten to make sure the consumers could qualify for rates similar to those we are seeing in the market.

Laird said for those who have seen their mortgage rates increase, some options to help pay down the balance could mean forgoing frivolities such as eating out or vacationing, while paying down lump sum payments if possible.

“Make a lump sum payment or an additional payment. That’s obviously helpful because it goes directly to your principal. But, I also feel silly saying that as I know Canadians are strained right now, and not a lot of people have extra money just sitting around looking for someplace to go,” said Laird.

He said the one thing not to do is miss a payment, and if that may occur, the best option is to reach out to the lender and look for options.

This may include extending the amortization to lower the monthly mortgage payment, however, it does extend the life of the load.

“The lenders are being pretty accommodating right now. What’s offered to each consumer is based on the situation … they listen to what’s going on,” said Laird.

CTVNews.ca Top Stories

B.C. tenants evicted for landlord's use after refusing large rent increase to take over neighbouring suite

Ashley Dickey and her mother rented part of the same Coquitlam duplex in three different decades under three different landlords.

MPP Sarah Jama asked to leave Ontario legislature for wearing keffiyeh

MPP Sarah Jama was asked to leave the Legislative Assembly of Ontario by House Speaker Ted Arnott on Thursday for wearing a keffiyeh, a garment which has been banned at Queen’s Park.

Mountain guide dies after falling into a crevasse in Banff National Park

A man who fell into a crevasse while leading a backcountry ski group deep in the Canadian Rockies has died.

Expert warns of food consumption habits amid rising prices

A new survey by Dalhousie University's Agri-Food Analytics Lab asked Canadians about their food consumption habits amid rising prices.

Here's why provinces aren't following Saskatchewan's lead on the carbon tax home heating fight

After Prime Minister Justin Trudeau said the federal government would still send Canada Carbon Rebate cheques to Saskatchewan residents, despite Saskatchewan Premier Scott Moe's decision to stop collecting the carbon tax on natural gas or home heating, questions were raised about whether other provinces would follow suit. CTV News reached out across the country and here's what we found out.

Montreal actress calls Weinstein ruling 'discouraging' but not surprising

A Montreal actress, who has previously detailed incidents she had with disgraced Hollywood producer Harvey Weinstein, says a New York Court of Appeals decision overturning his 2020 rape conviction is 'discouraging' but not surprising.

Charlie Woods, son of Tiger, shoots 81 in U.S. Open qualifier

Charlie Woods failed to advance in a U.S. Open local qualifying event Thursday, shooting a 9-over 81 at Legacy Golf & Tennis Club.

Caleb Williams, Jayden Daniels and Drake Maye make it four NFL drafts with quarterbacks going 1-3

Caleb Williams is heading to the Windy City, aiming to become the franchise quarterback Chicago has sought for decades.

Improve balance and build core strength with this exercise

When it comes to cardiovascular fitness, you may tend to focus on activities that move you forward, such as walking, running and cycling.