TORONTO -- Ontario's cash-strapped government plans to write off at least $1.4 billion in unpaid taxes because it failed to act promptly and lacked the manpower to collect them, auditor general Jim McCarter found in his annual report.

The province -- which is facing a $14.4-billion deficit -- is owed about $2.4 billion in taxes, mostly from businesses, the report found. But it isn't doing enough to collect them.

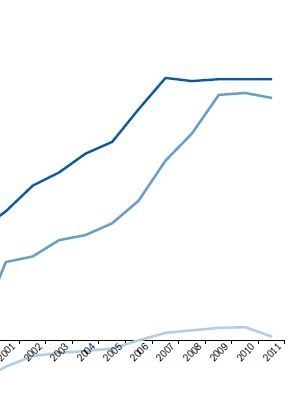

About three-quarters of Ontario's tax collectors were transferred to the federal tax agency after the governing Liberals brought in the harmonized sales tax in July, 2010. At the time, the Liberals boasted that the move would reduce their spending by taking public servants off their payroll.

But it also hindered the province's ability to collect billions in back taxes, with some collectors seeing their workload double or even triple.

It took collectors an average of seven months to even attempt to contact a taxpayer by phone, and in two-thirds of cases there was at least one six-month gap where no action was taken, the auditor found. Field visits weren't made, and liens and warrants for the seizure and sale of properties weren't enforced.

"Taking prompt action is vital to collecting debts," McCarter said in a release. "Research shows that the probability of collecting money that's owed drops dramatically as time passes."

The $1.4 billion is mainly made up of older accounts that have accumulated over years, the report said.

In one case where a liquor licensee owed $1.1 million in retail sales taxes, the branch didn't attempt to revoke their liquor licence. The taxpayer eventually agreed to pay off the debt gradually, but defaulted after three payments totalling just five per cent of the taxes owed. Two years later, they voluntarily gave up their licence just as it was set to expire.

The Canadian Revenue Agency collects personal income tax on behalf of the province. It started to administer the Corporations Tax in 2009 and the HST in 2010. But the Ministry of Finance's collections branch is still responsible for collecting the businesses and retail sales taxes prior to their transfer to the CRA.

There are only 62 provincial tax collectors and bankruptcy officers now, down from 264 before the transfer. The branch had some temporary workers to compensate for the loss until last March.

"Such a significant reduction in the branch's workforce, especially at the collector level, and the consequent increase in caseloads will further hinder the effectiveness of collection efforts on accounts where the probability of recovery still exists, and may well result in even more write-offs than expected at present," the report said.

McCarter also found examples where the government could do a better job in spending taxpayer dollars.

Overtime costs for the Ontario Provincial Police jumped 60 per cent since 2004 to $53 million, even though crime rates have dropped significantly and calls to the OPP for service have remained about the same since 2005. The auditor said his office couldn't locate 200 vehicles in the OPP fleet, although the police service later informed them that they had accounted for all the vehicles.

The report also found that the number of Crown attorneys has more than doubled over the last 20 years, but the total number of criminal charges they handle in a year has barely changed. The government has also done little analysis to figure out why it costs $437 on average to prosecute a charge in Toronto, compared to $268 in the rest of the province.

The Ministry of the Attorney General says cases require more time today, yet a money-saving project to manage and track cases electronically that was supposed to be completed in 2010 is still "plagued by delays," the report said.

The government also doesn't have the information to figure out why Ontario has Canada's highest rate of adult criminal charges withdrawn or stayed -- 43 per cent versus 26 per cent in the rest of the country -- and the lowest rate of guilty verdicts.

The government's much-touted Presto fare card system will be among the most expensive systems in the world by the time it's fully developed, with more than $700 million potentially paid to the contractor, the report found. And its purpose -- to integrate transit fare systems in the Greater Toronto Area and Hamilton -- has yet to materialize.

Metrolinx's Union Station renovation project has also seen significant cost overruns. The cost of restoring the train shed could reach $270 million -- 25 per cent more than initially estimated -- and replacing switches in the rail corridor could be more than twice than the $38 million on the original purchase order.

Metrolinx may have also overestimated the traffic on the Air Rail Link to Pearson Airport from Union Station, which means it may be a money-losing operation, the report said.