Homeowners in Waterloo Region and Wellington County began receiving their latest notices from the Municipal Property Assessment Corporation on Monday.

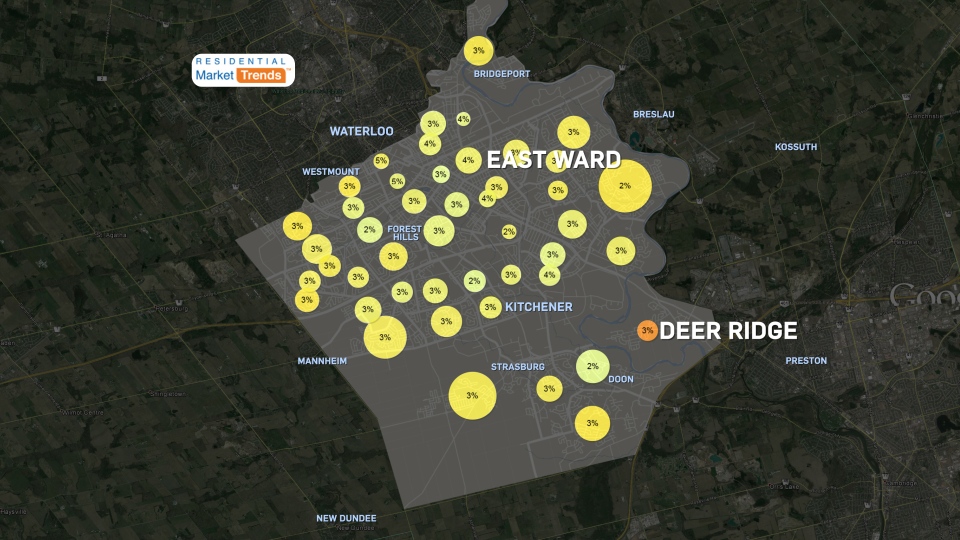

According to MPAC data, most neighbourhoods in Kitchener have seen average assessment increases of around three per cent, with some neighbourhoods in the north of the city going as high as five per cent.

In Guelph, the increase is even higher, at five or six per cent across the board.

While that may seem like good news on the surface, it actually has little to do with what houses will sell for.

Roy Singh, a Kitchener-based real estate agent, says sale prices typically have more to do with what else is on the market and how that stacks up to the home in question.

The main factors behind MPAC’s numbers, he says, are things like location, nearby amenities, the amount of living space and the size of the lot. Doing some work on the property helps too.

“If all of a sudden you’re doing a lot of renovations, your property assessment will go up,” he said.

The main user of MPAC data is municipalities, which base tax assessments off of MPAC’s values.

Singh says an increase to your home’s value on its own won’t increase your taxes – unless your neighbours don’t seem to be keeping pace.

“As long as property assessments are all going up together, it’s not going to impact the taxes that they’re paying,” he said.

With reporting by Leena Latafat