Experts warn changes to mortgage rules could drive up home prices

Some mortgage professionals are sounding the alarm over the federal government’s latest mortgage rule changes – and the costs that come with them – for first-time homebuyers.

On Monday, Finance Minister Chrystia Freeland announced a higher cap on insured high-ratio mortgages from $1 million up to $1.5 million.

First-time buyers will also be eligible for 30-year amortization mortgages for any type of home, up from the previous 25-year limit.

“This allows people that are in those areas, that are looking to buy over $1 million, a little bit more leverage,” Mortgage Agent Amanda Lawson told CTV News.

According to the government, the move will make it easier for Canadians wanting to get into home ownership.

Victor Tran, a mortgage and real estate expert with RATESDOTCA, said it might not be that easy.

“This kind of opens up a bigger segment of the market for some home purchasers, but of course, it’s going to come at cost,” he said.

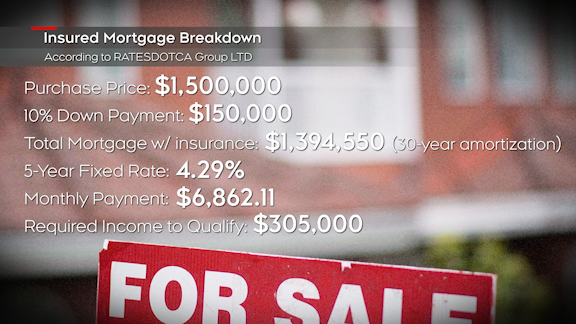

Tran warns the changes could lead to higher insurance premiums and steeper monthly payments on mortgages.

Lawson said lower down payments could make pre-approval too big of a hurdle for buyers with larger mortgages.

“You need to make a lot of money to be able to buy a $1.5 million property with less than 20 per cent down,” she said.

The example below breaks down the mortgage for a $1.5 million home with 10 per cent down, according to RATESDOTCA Group LTD.

Impact on home prices

Tran said there are higher-income individuals “sitting on the sidelines” before getting into the market.

“This new rule will allow them to enter the market earlier,” he explained.

Tran warns more high-income buyers run the risk of driving up home prices and pushing ownership further out of reach for those who don’t make as much.

The new mortgage rules come into effect on Dec. 15.

CTVNews.ca Top Stories

Man who peed on B.C. RCMP detachment injured during arrest, watchdog says

A police watchdog is asking witnesses to come forward after a man who allegedly peed on a B.C. RCMP detachment "sustained an injury" during his arrest.

Parts of Canada could welcome 2025 with glimpse of Northern Lights

While fireworks have become a popular way to celebrate the arrival of the new year, many Canadians could be treated to a much larger light display across the night sky.

Debris found at St. John's airport after plane takes off, catches fire on N.S. runway

The Transportation Safety Board of Canada says it is investigating whether debris found on the runway of an airport in St. John's is connected to the plane that caught fire over the weekend after it landed on a Halifax runway.

BREAKING 'Dangerous person alert' ended as police locate dead suspect in Calgary double murder

The suspect in a double homicide that took place in Calgary on Sunday night has been discovered dead by police.

More than US$12M worth of jewelry and Hermes bags stolen from U.K. home

Police are searching for a burglar who stole more than £10 million ($12.5 million) worth of bespoke jewelry in north-west London in what is thought to be one of the biggest thefts from a British home.

Border agents seize $2M worth of cocaine at Canada-U.S. border

Authorities at the Coutts, Alta., border crossing seized 189 kilograms of cocaine, with an estimated value of about $2 million, that was being shipped into Canada.

Matthew Gaudreau's widow welcomes their first child months after his death

Four months after his death, the widow of Matthew Gaudreau announced the birth of their first child. Gaudreau, 29, and his NHL star brother Johnny Gaudreau, 31, were killed after being struck by a driver in August.

'McDonald's wouldn't open': Here are B.C.'s 10 worst 911 nuisance calls of the year

What do overripe avocados, stinky cologne and misplaced phones have in common? Generally speaking, none of them warrant a call to 911.

Ontario labour ministry investigating injury on Toronto set of 'Beast Games'

Ontario's labour ministry is investigating an industrial accident on the Toronto set of 'Beast Games,' the newly released Prime Video competition series from YouTube star MrBeast.