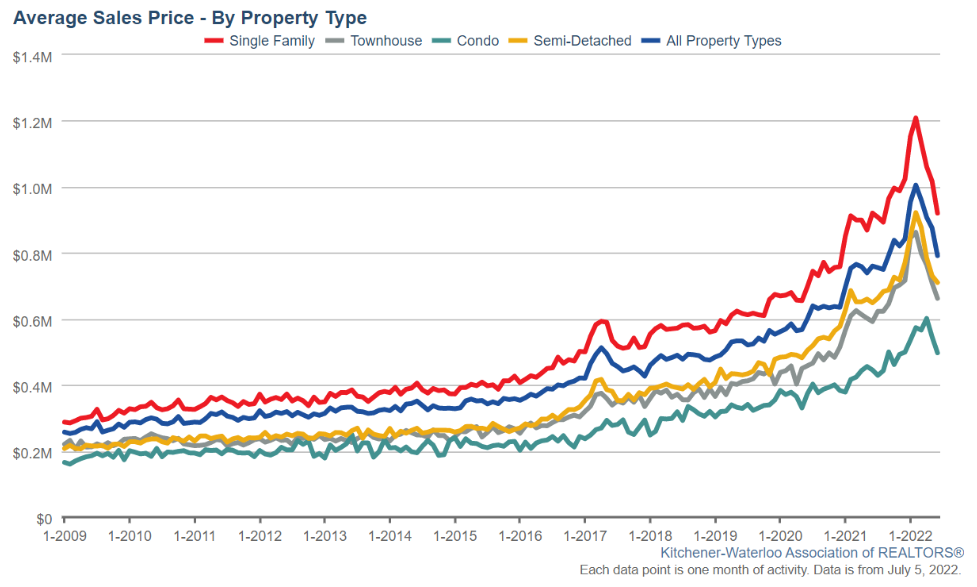

Average home sale price in K-W drops for fourth straight month

The average home sale price in Kitchener-Waterloo fell for the fourth straight month in June.

The Kitchener-Waterloo Association of Realtors says the average sale price across all property types was $791,674 last month – that’s down 9.6 per cent from May and 24 per cent from February when it topped $1 million at $1,007,109.

When it comes to detached homes, the average sale price hit $920,349 in June, the first time it’s fallen below $1 million since November 2021.

Home sales also continue to slow, 561 homes were sold through KWAR’s listing service system last month, that’s a decrease of 24 per cent over the same month last year and 17.3 per cent below the five-year average

“This time last year, sales were going through the roof,” Megan Bell, president of KWAR said. “The home buying scene is a little different this year with folks finally taking their postponed trips, attending weddings, and generally catching up on the many missed occasions of the past two years.”

Bell also said as people begin returning to the office, less buyers are looking for a commute and therefore less are moving to Waterloo region from elsewhere.

(Kitchener-Waterloo Association of Realtors)

(Kitchener-Waterloo Association of Realtors)

Bell said recent mortgage rate hikes are also contributing to the cooling, but she warned against jumping to conclusions.

“While any shift in the market will result in some individuals predicting the worse, the simple reality is that the market we had been in was unsustainable,” Bell said.

“What this means for buyers is more inventory, more choices, and perhaps most importantly, potentially less stress when purchasing. For sellers, they need to ensure their properties stand out from the competition and be aware it may take more time to sell their home and for potentially less money than they were expecting.”

She said ultimately, buyers and sellers can both look at this as a positive. While the former can take their time choosing a home, the later can be assured the person buying their property is financially stable.

Here are the June average sale prices by home type:

- Detached home: $920,349, no change from June 2021

- Townhouse: $662,305, 11.9 per cent increase from June 2021

- Apartment-style condo: $497,429, 11.7 per cent increase from June 2021

- Semi-detached home: $710,284, 9.5 per cent increase from June 2021

POSSIBLE RATE HIKE FROM THE BANK OF CANADA

Many experts are forecasting another interest rate hike could happen as early as next week.

“We're expecting the Bank of Canada to raise interest rates by 0.75 per cent at this turn,” mortgage broker and Lowestrates.ca expert Leah Zlatkin said. “It is possible they could raise it as much as a point and it is possible they could also only raise it 0.5 per cent.”

Zlatkin suggests the time to tighten the budget is now, adding the current stress test exists for moments like this.

She said if you're a first time buyer who has pre-qualified, but has not yet purchased, you may want to double check that you can still afford the home you've had your eye on.

“That's something to keep in mind, that your budget may have shifted, if the Bank of Canada raises rates,” Zlatkin said.

CTVNews.ca Top Stories

Teenage phenom Gavin McKenna scores, Canada tops Finland 4-0 in world junior opener

Teenage sensation Gavin McKenna scored late in the first period and Carter George made 31 saves for the shutout as Canada picked up a 4-0 victory over Finland in the host country's opener at the world junior hockey championship Thursday.

Ministers Joly, LeBlanc travel to Florida to meet with Trump's team

Two members of Prime Minister Justin Trudeau's cabinet will be in Palm Beach, Fla., Friday to meet with members of Donald Trump's team.

Hwy. 401 off-ramp shut down due to Boxing Day deal-hunters now reopen

A Highway 401 off-ramp west of Toronto that became so clogged up with Boxing Day deal-hunters Thursday that police had to shut it down out of safety concerns has re-opened.

India alleges widespread trafficking of international students through Canada to U.S.

Indian law enforcement agencies say they are investigating alleged links between dozens of colleges in Canada and two 'entities' in Mumbai accused of illegally ferrying students across the Canada-United States border.

Teen actor Hudson Meek, who appeared in 'Baby Driver,' dies after falling from moving vehicle

Hudson Meek, the 16-year-old actor who appeared in 'Baby Driver,' died last week after falling from a moving vehicle in Vestavia Hills, Alabama, according to CNN affiliate WVTM.

B.C woman awarded nearly $750K in court case against contractor

A B.C. woman has been awarded nearly $750,000 in damages in a dispute with a contractor who strung her along for a year and a half and failed to complete a renovation, according to a recent court decision.

Florida pizza deliverer charged with stabbing pregnant woman after tip dispute

A pizza deliverer in central Florida has been charged with pushing her way into a motel room with an accomplice and stabbing a pregnant woman after a dispute over a tip, authorities said.

2 minors, 2 adults critically injured in south Calgary crash; incident was preceded by a robbery

Multiple people were rushed to hospital, including two minors, in the aftermath of a serious vehicle collision on Thursday morning.

Christmas Eve stowaway caught on Delta airplane at Seattle airport

A stowaway was caught trying to nab a ride on a Delta Air Lines plane at Seattle-Tacoma International Airport on Christmas Eve.