TORONTO -- The founders of BlackBerry are in discussions to partner with investment firm Cerberus Capital Management LP to make a competitive bid for the struggling technology company.

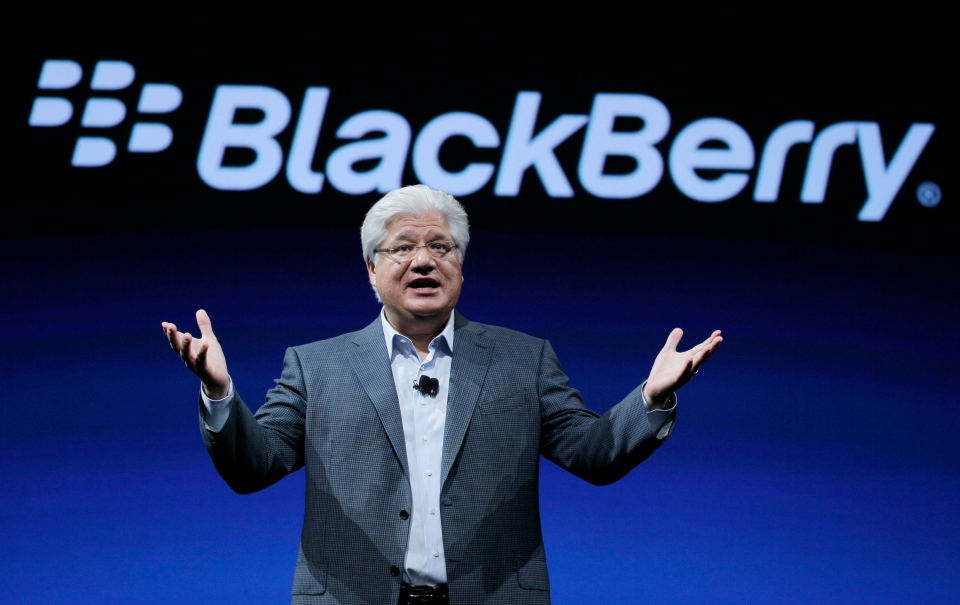

A source familiar with the process said that Mike Lazaridis and Doug Fregin began talks with Cerberus in hopes that an agreement could be ironed out before a key deadline next week.

The source asked not to be named because they weren't authorized to speak on the matter.

The potential group includes other parties that could join an official bid, including cellphone chip maker Qualcomm Inc., the source said.

Representatives for both Cerberus and Qualcomm declined to comment on whether they are in negotiations.

The move comes ahead of a deadline set for Monday for potential bidders for BlackBerry (TSX:BB) assets.

At that time, a due diligence period ends for Fairfax Financial (TSX:FFX), BlackBerry's largest shareholder, which made a conditional US$9-per-share offer for the company in September.

Together, Lazaridis and Fregin own roughly an eight per cent stake in BlackBerry, while Fairfax holds about 10 per cent.

Cerberus has a long relationship with Canadian companies and in 2004 helped rescue Air Canada (TSX:AC.B) from bankruptcy.

In 2008, Canadian Imperial Bank of Commerce (TSX:CM) sold part of its structured credit portfolio to Cerberus in a US$1.05-billion deal as it backed away from exposure to the U.S. residential mortgage market.

BlackBerry shares closed 14 cents lower at $8.09 on Friday at the Toronto Stock Exchange.