Young people in K-W need to save for an average of 20 years to afford a down payment: report

Amanda Luloff lives in a two-bedroom apartment in Cambridge, but has been looking for a house to call home for years.

“Today’s housing market is very hard,” the single parent says. “I’m 43-years-old, I’m a single mom. I feel like I’ll never be able to own a home.”

While it’s not difficult to find people in Luloff’s situation in Waterloo region and across the country, a new report shows just how drastically housing prices have outpaced many people’s budgets.

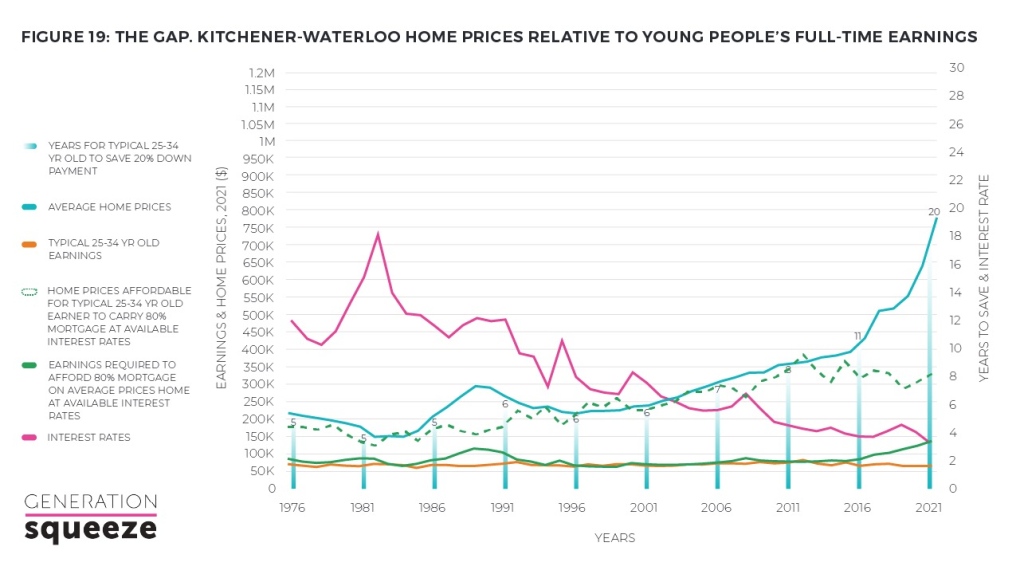

Comparing average earnings to average home prices, the charitable think tank Generation Squeeze determined it would take a typical young person in Kitchener-Waterloo 20 years of full-time work to save a 20 percent down payment on an average-priced home.

In 1976, a typical 25 to 34 year old earner could save a 20 per cent down payment in five years.

“Ontario’s lost control of home prices more over a two year period than any other province at any other time in the last half century,” says Paul Kershaw, the founder and lead researcher of Generation Squeeze.

The group’s "Straddling The Gap" report shows house prices need to drop by more than $500,000 for a typical young person to afford an average home in Ontario. In Kitchener-Waterloo, prices need to drop by more than $445,000.

A graph of Kitchener-Waterloo home prices relative to 25 to 34 year olds earnings. (Generation Squeeze)

A graph of Kitchener-Waterloo home prices relative to 25 to 34 year olds earnings. (Generation Squeeze)

“Too often we tend to sort of individualize the harm that’s happening to younger Canadians in our housing market as opposed to talking about how our housing system is quite dysfunctional,” Kershaw says.

After analyzing data from the Canadian Real Estate Association and comparing it to Statistics Canada data on annual income, the report concludes that home prices should stall for years ahead or continue to fall moderately.

HOUSING MARKET COOLING

Alexis Soha with the Noble Realty Group in Kitchener says she has already seen a downward pressure in the cost of homes.

“I have seen a decrease in home prices, for sure,” Soha says. “Part of that is the rising interest rates that are factoring in. It’s costing more to own a house, especially now with inflation and the day-to-day cost of living. All of this is coming into play when it comes to impacting prices in the market.”

While Luloff saves every month for a home, she says it’s easier said than done and worries for her young daughter’s future when she too will need a home.

“What is it going to look like in 16 years when she wants to buy, when she wants to move? If the economy is so up right now, what is it going to look like for my four-year-old,” she says.

In its latest monthly release, the Waterloo Region Association of Realtors reports the housing market saw a continued cool down in November with the number of home sold year-over-year down by nearly 44 per cent and the average sale price dropping more than 10 per cent.

The stall is something Generation Squeeze argues needs to continue for many years ahead to make housing more attainable for would-be buyers.

CTVNews.ca Top Stories

Cuban government apologizes to Montreal-area family after delivering wrong body

Cuba's foreign affairs minister has apologized to a Montreal-area family after they were sent the wrong body following the death of a loved one.

What is changing about Canada's capital gains tax and how does it impact me?

The federal government's proposed change to capital gains taxation is expected to increase taxes on investments and mainly affect wealthy Canadians and businesses. Here's what you need to know about the move.

'Anything to win': Trudeau says as Poilievre defends meeting protesters

Prime Minister Justin Trudeau is accusing Conservative Leader Pierre Poilievre of welcoming 'the support of conspiracy theorists and extremists,' after the Conservative leader was photographed meeting with protesters, which his office has defended.

Fair in Ontario, flurries in Labrador: Weather systems make for an erratic spring

"It's a bit of a complicated pattern; we've got a lot going on," said Jennifer Smith of the Meteorological Service of Canada in an interview with CTVNews.ca on Wednesday. "[As is] typical with weather, all of these things are related."

Quebec nurse had to clean up after husband's death in Montreal hospital

On a night she should have been mourning, a nurse from Quebec's Laurentians region says she was forced to clean up her husband after he died at a hospital in Montreal.

Police tangle with students in Texas and California as wave of campus protest against Gaza war grows

Police tangled with student demonstrators in Texas and California while new encampments sprouted Wednesday at Harvard and other colleges as school leaders sought ways to defuse a growing wave of pro-Palestinian protests.

Bank of Canada officials split on when to start cutting interest rates

Members of the Bank of Canada's governing council were split on how long the central bank should wait before it starts cutting interest rates when they met earlier this month.

Northern Ont. lawyer who abandoned clients in child protection cases disbarred

A North Bay, Ont., lawyer who abandoned 15 clients – many of them child protection cases – has lost his licence to practise law.

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.