Tax return delays possible if CRA workers strike

Thousands of Canada Revenue Agency workers are threatening strike action, and it could cause a delay for Canadians trying to file their 2022 taxes by the May 1 deadline.

In January, the Public Service Alliance of Canada and the Union of Taxation Employees announced a strike vote.

They represent more than 35,000 workers nationwide.

The union’s most recent collective agreement expired on Oct. 31, 2021.

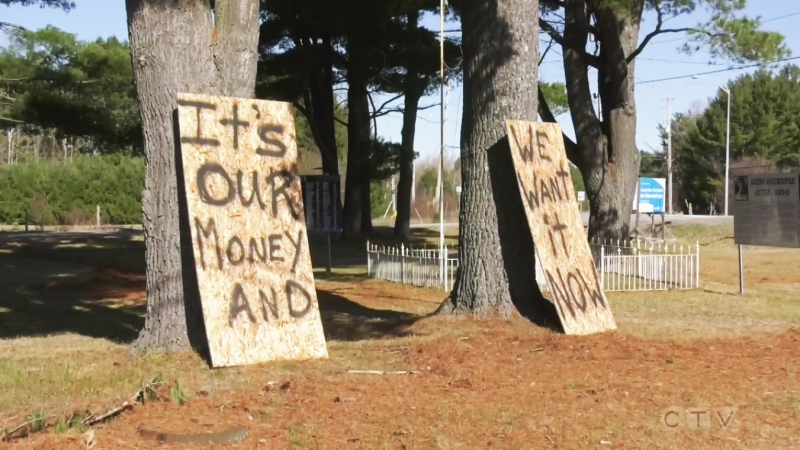

The workers are asking for “a fair compensation package, protections in the context of access to remote work, new protections for union jobs and new scheduling rights, including years of service protections where there is evening and weekend work.”

“It’s just been accumulating, years of frustration, so we do not need to convince them,” said Marc Briere, national president of the Union of Taxation Employees. “They are all in favour of voting for a strike.”

He explained that members feel ignored and they haven’t received a wage offer since the agreement ended.

“That, and a slap in the face, feels pretty much the same,” he said. “We’re still hoping that we’ll avoid a strike, but if people think that we’re going to just hesitate, we will not.”

The federal government can pass legislation to force employees back to work, but Briere hopes the two sides can reach an agreement before it gets to that point.

IMPACT ON TAX RETURNS

Voting on strike action, which began back in January, will end on April 7.

As that comes just weeks before the filing deadline, Canadians could experience delays in accessing CRA services.

“Hopefully it doesn’t happen because it could be a real nightmare if it does,” said Lars Jorgensen, the president of EJ Tax Service in Kitchener.

Most tax returns are automated but the strike could cause major delays for some.

“You file a tax return and it just gets processed instantly in most cases, but the call centres are a valuable tool to a lot of people,” explained Jorgensen. “If they’re not able to access that information it could really cause some major headaches.”

Jorgensen said the CRA could extend the May 1 deadline in response to prolonged strike action but his advice is to file sooner rather than later.

CLAIMING PERSONAL TAX CREDITS

Before you file your 2022 taxes, make sure you know what personal credits you qualify for.

The province is offering a Staycation Tax Credit which allows Ontarians to claim 20 per cent of eligible accommodation expenses between Jan. 1 and Dec. 31, 2022. You can find out more about the credit, and how to claim it on your return, here.

There is also the Ontario Seniors Care at Home tax credit,which aims to help low to moderate-income seniors with their medical expenses, and the Childcare Access and Relief from Expenses (CARE) tax credit. To find out more about those and other tax tips, click here.

CTVNews.ca Top Stories

Doctors say capital gains tax changes will jeopardize their retirement. Is that true?

The Canadian Medical Association asserts the Liberals' proposed changes to capital gains taxation will put doctors' retirement savings in jeopardy, but some financial experts insist incorporated professionals are not as doomed as they say they are.

Something in the water? Canadian family latest to spot elusive 'Loch Ness Monster'

For centuries, people have wondered what, if anything, might be lurking beneath the surface of Loch Ness in Scotland. When Canadian couple Parry Malm and Shannon Wiseman visited the Scottish highlands earlier this month with their two children, they didn’t expect to become part of the mystery.

Fair in Ontario, flurries in Labrador: Weather systems make for an erratic spring

It's no secret that spring can be a tumultuous time for Canadian weather, and as an unseasonably mild El Nino winter gives way to summer, there's bound to be a few swings in temperature that seem out of the ordinary. From Ontario to the Atlantic, though, this week is about to feel a little erratic.

What a urologist wants you to know about male infertility

When opposite sex couples are trying and failing to get pregnant, the attention often focuses on the woman. That’s not always the case.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Bank of Canada officials split on when to start cutting interest rates

Members of the Bank of Canada's governing council were split on how long the central bank should wait before it starts cutting interest rates when they met earlier this month.

Quebec nurse had to clean up after husband's death in Montreal hospital

On a night she should have been mourning, a nurse from Quebec's Laurentians region says she was forced to clean up her husband after he died at a hospital in Montreal.

Northern Ont. lawyer who abandoned clients in child protection cases disbarred

A North Bay, Ont., lawyer who abandoned 15 clients – many of them child protection cases – has lost his licence to practise law.

An Ontario senior thought he called Geek Squad for help with his printer. Instead, he got scammed out of $25,000

An Ontario senior’s attempt to get technical help online led him into a spoofing scam where he lost $25,000. Now, he’s sharing his story to warn others.