KITCHENER -- A number of people are saying their identities were stolen and used to cash in on the Canada Emergency Response Benefit (CERB).

The program was originally put in place to quickly provide money to people who lost their job during the COVID-19 pandemic.

Between Thursday Night and Friday morning however, Leah Baverstock got three emails regarding CERB.

“I got an email from CRA saying my direct deposit information had been changed,” she said. “Then there were two other emails that I was approved for the CERB benefit for July and August and I would get funds in two to three days.

“I didn’t apply for the CERB benefit – I’m still working.”

Alison Turner says she was terrified while going through a similar experience.

“Knowing that you have so much information on your CRA account and knowing that they have access to all of that information,” she said.

Nicole Lumbers is one of many others with an identical story of someone getting into their CRA account, changing their direct deposit information, and applying for CERB.

“From the comfort of their own home they walked away with $4,000 in my name,” she said.

The Canadian Anti-Fraud Centre says they’re getting a number of reports about this COVID-19 scam and that it’s tough to stop because it can be carried out quickly.

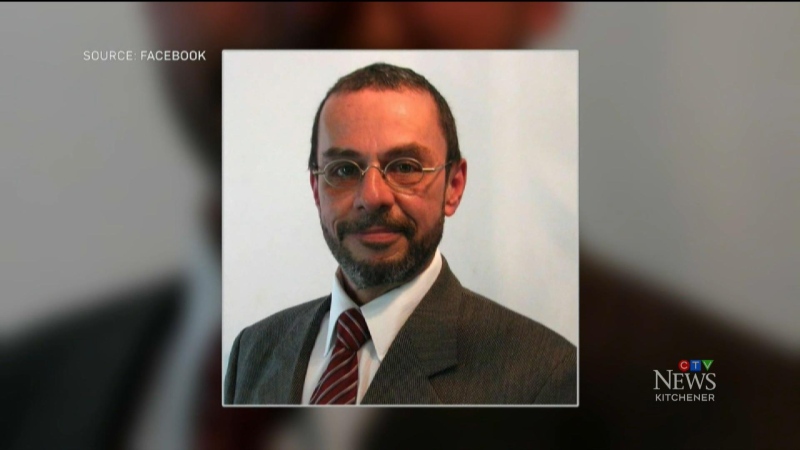

“The fraudsters have found a loophole somewhere and they’re exploiting it,” said Jeff Thomson, senior RCMP intelligence analyst. “With identity fraud victims, in a lot of cases the reverse onus is on the victim to clear their good name, so it’s a lot of time spent reporting.”

In a statement, the CRA says scammers can get taxpayers’ personal information through phishing scams and data leaks.

They add that they are trying to identify and prevent high risk or suspicious applications, and anyone that’s confirmed to be a victim of identity fraud won’t be held responsible for any money paid out to scammers.

“Don’t think it won’t happen to you, because guess what? It can,” said Lumbers.

The Canadian Anti-Fraud Centre suggests not giving out personal information, not being afraid to say no, and being careful who images are shared with as ways to prevent scams or fraud.

They say that victims of fraud should collect all information relating to the fraud like documents, receipts, and emails, contact their financial institution, contact the police, and then report the incident.