As some economists begin to wonder if a recession is on the horizon, one local real estate broker says this potential lead up feels different.

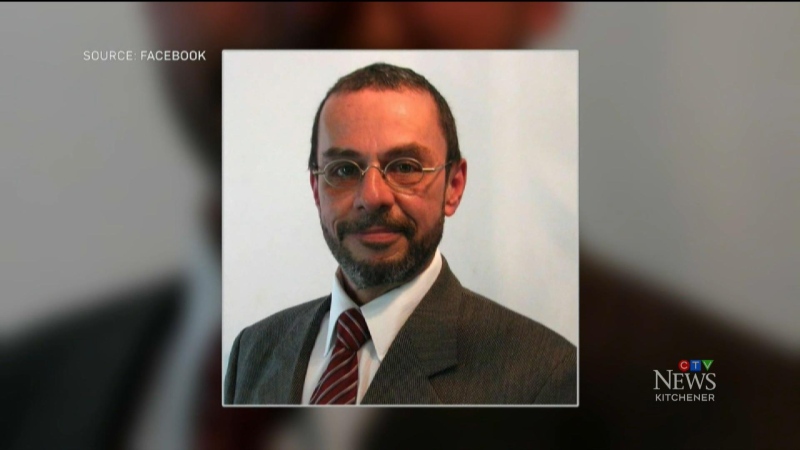

Faisal Susiwala has worked in Waterloo Region's housing market through multiple recessions.

"The difference is, there's employment right now, there's immigration right now, just the demand has stopped," he told CTV News. "Because it's easier to stop and pause when there's change happening and that's what we will see changing out probably in the next two years."

Susiwala is already feeling some winds of change, especially within the local housing market, as fewer migrants are moving to Waterloo region from bigger cities.

This, he says, is likely because housing prices are cooling while interest rates and gas prices continue to rise.

MORE: Nearly 1 in 4 homeowners would have to sell if interest rates rise more, survey finds

Susiwala's clients are finding the move out of the GTA, towards southwestern Ontario, doesn’t come with the savings appeal it once did.

"We are actually saving $100,000 now by moving to Cambridge or Kitchener, where as before it was a $300,000 savings," he says. "So the gap is narrow, but the fuel costs are impacting people's commuting and they're saying: 'Well, we will put that money towards a mortgage instead of gas.'"

The housing market is also changing.

"We’re not seeing as many multiple offers," says Megan Bell, the president of the Kitchener-Waterloo Association of Realtors. "Buyers are able to finally get some conditions in. They’re able to take their time."

"So we are trending towards a balanced market," she adds. "But it is still a sellers market. It’s just not the craziness that we’ve seen."

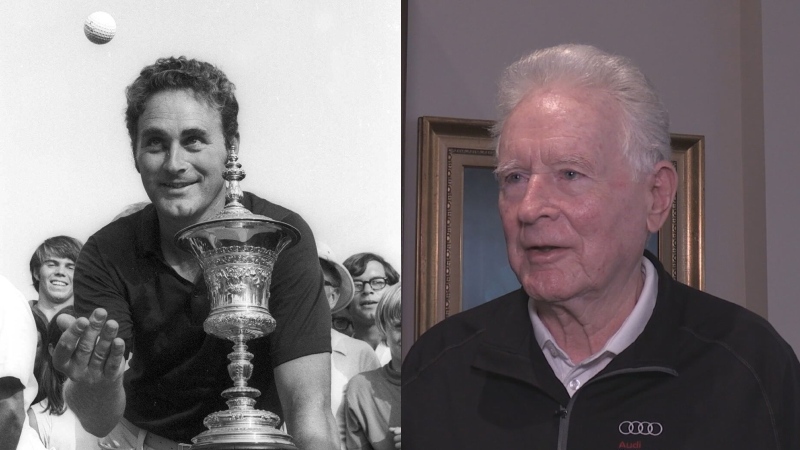

Chester Szypula, the senior vice-president of BDO Canada Limited, says we're starting to see the effects of the market peak from a few months ago.

"$100,000, $150,000 over asking price, people [are] really put themselves out there, further than they could truly afford."

Szypula says BDO is receiving more calls as people search out help for their increasing debt.

"The interest rate is certainly creating a concern for a lot of individuals. That, as well with the inflation and all the costs increasing, the price of gas, etc."

Now the market is leaning more towards those once-starved buyers.

"Just a few months ago, they were tumbling over each other to buy a home," Susiwala says. "This is a good time to really put thought behind purchasing and get into the market."

Some buyers may choose to wait it out a little while longer, unless they can with stand the stress test, along with the rising cost of everything else.