Cryptocurrencies have made some people rich, changed the way online transactions are made, and shaken up investment portfolios.

But the volatile currencies remains a mystery to most.

Cryptocurrency is not like regular fiat currencies, which are made and controlled by the world’s federal governments. It’s decentralized, with no central bank.

To understand the origins of cryptocurrency, we have to understand what the world was facing at the time it was born.

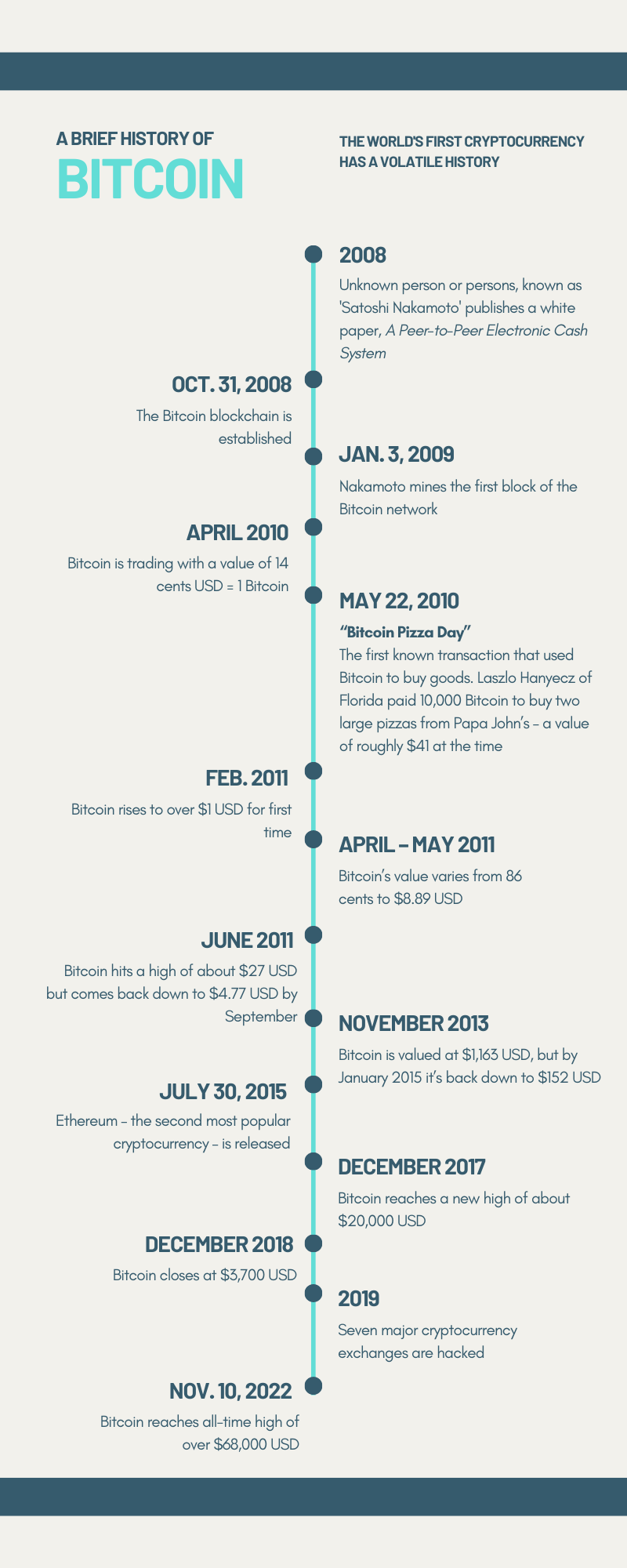

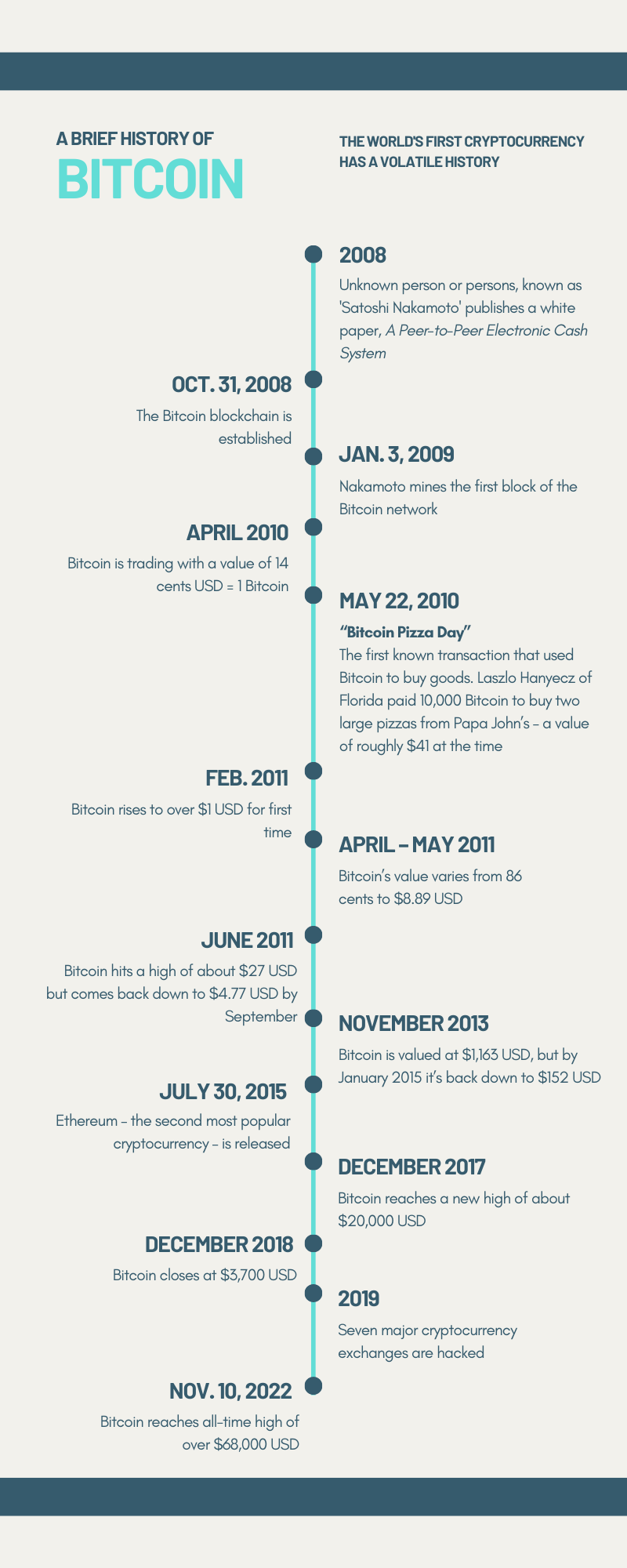

HISTORY OF CRYPTOCURRENCY

In the 2008 financial crisis, the housing and stock markets collapsed.

“There are people who believe the current monetary system that is run by the government is not worthy of our trust,” says George Bragues, assistant vice-provost and program head of business at the University of Guelph-Humber.

“And back then there was a lot of criticism that the central banks – the Bank of Canada, the Federal Reserve in the United States – were printing their way out of the crisis and cheapening the currency.”

“A lot of people back of then lost their shirts because – especially in the finance industry – they were investing in this product they thought was going to make them a lot of money, but they did not understand whatsoever,” says Othalia Doe-Bruce, the founder of InnovFin Consulting Inc., and an investment and blockchain consultant.

As people lost their investments, retirement savings, and their homes, an idea first floated in the 1980s took solid shape.

Bitcoin – the world’s first cryptocurrency – was born.

“It definitely grew out of a skepticism to the current financial system,” says Anne Haubo-Dyhrberg, an associate professor at Wilfrid Laurier University’s Lazaridis School of Business.

“This is completely decentralized, it can’t be tampered with by any government or institution,” she adds.

BIRTH OF BITCOIN

In 2008, an unknown person or persons, known as Satoshi Nakamoto, published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

On January 3, 2009, Nakamoto mined the first block of the Bitcoin network.

“[Mining] basically involves solving really complex mathematical problems," explains Bragues. "And when you solve the problems, then you earn Bitcoin. So the mining is the way that is used by the cryptocurrency community to incentivize people to get involved in cryptocurrency, to maintain the public ledger, and to ensure that all transactions are validated.”

Miners maintain what’s called the blockchain – a ledger that exists on computer networks across the world.

“It basically records every transaction, every sale or purchase of Bitcoin that has ever occurred,” says Bragues. “What the miners do is help validate the transactions to make sure that the people who are using Bitcoin … that they actually have it.”

The ledger exists in computer code, and in more than one place throughout the world.

Bragues says this helps keep the currency decentralized, as it’s overseen across a variety of computer networks making it nearly impossible to change the transaction records.

“[This ledger] is made up of a series of blocks, each of the blocks contain a transaction, so you can’t break the blockchain,” he says. “That’s what makes it so resilient, what makes people trust it so highly.”

Bitcoin also comes in a finite amount of 21 million. About 19 million of it has already been “mined” and is circulating.

The limited supply is meant to be a safeguard against inflation.

Bragues explains this is different than centralized currency where a government can issue as much of it as they want.

But as Haubo-Dyhrberg explains, that's not the only way of setting up a cryptocurrency.

“That’s one of the really specific features of Bitcoin," says Haubo-Dyhrberg. "But for a lot of other cryptocurrencies – for example [Ethereum] – you can create more if you wanted to.”

Bitcoin is the first cryptocurrency, but it’s not alone.

In 2017, Ethereum was created by University of Waterloo drop-out Vitalik Buterin.

Ethereum is now considered the second most popular form of crypto, but there are about 18,000 types of cryptocurrencies in existence.

Bragues says not all of them will survive, and eventually many of them will consolidate.

USING CRYPTOCURRENCY

The experts say cryptocurrencies aren’t practical for everyday purchases.

With Bitcoin, multiple miners have to verify each transaction and that can typically take an hour.

“It’s not super useful, buying coffee with it,” says Haubo-Dyhrberg. “A lot of people so far have primarily been using it for investment. And if we all bought Bitcoin in 2009, it would have been amazing.”

Bragues says it can seem like an attractive investment option, given Bitcoin and Ethereum’s massive gains in recent years.

But he says novices to investing shouldn’t start with cryptocurrency because of its “extremely high volatility.”

“Just over the past few years, you’ve seen declines in the price of Bitcoin of more than 50 per cent within a relative short period of time,” he says. “Right now, Bitcoin is about $40,000 US per Bitcoin, and that’s off about 40 per cent off its highs back in November. If you do decided to go into this field, I would not suggest devoting more than 10 per cent of your investable funds in this area. maybe even five per cent, it’s that risky.”

“If you only invest what you’re willing to lose, then you don’t have to worry about it,” says Doe-Bruce.

BUYING CRYPTO, AND KEEPING IT SAFE

If you want to buy cryptocurrency, there are many exchanges now regulated in Canada.

“You would go to one of the Canadian cryptocurrency exchanges, and exchange your fiat currency for any kind of crypto you might want to use,” says Haubo-Dyhrberg.

“Very similar to opening an account with a stock brokerage firm,” says Bragues.

But once you have it, keeping it safe is the next step.

Haubo-Dyhrberg explains when you buy Bitcoin on the currency exchange, it stays on the blockchain in that exchange’s wallet.

“So if their wallet gets hacked, then your Bitcoin can be compromised,” she says, adding the safest thing you can do is move it off the exchange into your own “wallet.”

“It’s either a website or it’s an app,” she says.

“Then it becomes how you then keep that secure, and that is very much about where you keep your private key to that wallet.”

The key is a very long password made up of a random sequence of numbers, letters and symbols. It’s not easy for humans to memorize.

“Typically for the actual key storage, you will have a little device, a physical device for security reasons. Because you don’t want your private key to be stored on your laptop which is then connected to the Internet if your laptop gets hacked.”

WOMEN IN CRYPTO

The possibility of being hacked and its high-volatility make cryptocurrency a risky investment.

But it seems more men are willing to take the plunge.

Recent surveys show fewer than five per cent of Canadian crypto owners are women.

It’s a statistic Janelle Chalouhi stumbled across after having a conversation about crypto with her friend Natalie Dumond.

“She was literally the only other woman I’d had a conversation with that was actually interested in the space and knew what I was talking about,” says Chaloui.

“Just seeing that massive disparity to me, just set off a lightbulb in my head. Because it’s very understandable as to why. Crypto is a new world, Web3 is a new world, there wasn’t a lot of information out there.”

“The number one factor is the way that women invest, versus the way men invest,” says Doe-Bruce.

“Men traditionally … tend to take a lot of risks when they know that the potential for high reward is there. Women tend to be very careful with money, which is good, actually. They will think twice before making a risky bet.”

And Doe-Bruce says cryptocurrencies are a very risky asset class.

“You want to be very cautious in terms of how much you’re investing in it, but also what you’re investing in,” she says.

“And it’s not just what women should know, it’s also what men should know before they take the plunge.”

Chalouhi says the crypto world was very overwhelming when she first started.

“And it still is, by the way, because there wasn’t a centralized place to go for information,” she adds.

That’s when Chalouhi and Dumond decided to do something with what they’d learned, to try to close that gender gap.

They founded VenusVerse – a Waterloo startup that provides an online resource for women across Canada to learn about crypto, blockchain, NFTs, and Web3.

“Basically what we’ve done is condense about four to six months of research into an hour and a half [session],” says Chalouhi. “Just kind of laying the land for them to understand what’s happening out there at this time … so that they can also then go back and potentially apply it to their lives.”

Still in its beginnings, VenusVerse also plans to release an NFT collection and become a Web3 incubator in the future for female entrepreneurs.

“So the idea is we would have any woman who’s looking to dabble in the Web3 world would come into the incubator and we would help them figure out which path they should be looking at,” says Chalouhi. “Whether its builders looking to get into smart contracts, or coders or NFT artists — the idea is to help incubate that talent.”

“Education is super important,” says Doe-Bruce. “At the same time, there is a lot of opportunity in cryptocurrencies. Once you’ve educated yourself then you’ll know what and how and why to invest in it.”

THE FUTURE OF THE DIGITAL LANDSCAPE

So what does the future of this new digital world hold?

When it comes to cryptocurrencies, Bragues thinks it will eventually become bigger than what it is today.

“But it will not take over the functions played by government-backed currencies,” he says. “For one reason, governments have a very strong interest to resist the further rise of cryptocurrency, and that’s because governments rely [on] their control of their money supply to manage their economies.”

“I think one of the really big and exciting things about this … is very much can we actually create a cryptocurrency, or something of the like, where we can substitute fiat currencies online?” asks Haubo-Dyhrberg.

“If something like that takes off, and actually we can use that to do all of our e-commerce, all of this kind of stuff where we usually have to put in the information to our credit cards — which isn’t entirely secure either — something like that would be the biggest change to just you and I, and regular people.”

Bragues agrees it could become more integrated in everyday life for online transactions and money transfers.

“And if you believe in the Metaverse, which Facebook is pioneering, then there’s going to be this whole different virtual reality where people will be using their cryptocurrency to live their virtual lives,” says Bragues.

Chalouhi says with some of the world’s biggest brands already getting into the Web3 world, that future will come quickly.

“With COVID-19, we had to do a lot of hybrid work and it was still clunky, it wasn’t always perfect,” she says. “But to me, Web3 is the next iteration of hybrid. It’s a virtual space where it’s more interactive, it’s more immersive, there’s more of an experience.”

Chalouhi thinks there will be a lot of events and experiences we’ll be able to have, without having to fly across the world.

“You know it’s no mistake that Disney’s building their own Metaverse … with an amusement park,” she says.

Chalouhi explains you could watch soccer games, concerts, or attend meetings and summits in the virtual space.

“You can just potentially just put on glasses – maybe even contact lenses down the road – and then end up in a conference or a meeting room, meeting someone from across the globe and have a more immersive experience.”