Part 1: Tax reassessments don't only hit those with irregularities

When Paul and Holly Miller saw their 2012 tax assessment, the Waterloo couple thought they’d hit the jackpot.

“It said we got … about a thousand dollars back,” recalls Holly.

Although their accountant was unable to explain the surprise windfall and warned the Millers against spending it too quickly, the couple decided to put it to use.

Son Emmitt had been born only a few weeks earlier, and the Millers paid for clothes, toys and other typical newborn needs with their unexpected baby bonus.

But not long after the money was spent came word from the Canada Revenue Agency that the refund that seemed too good to be true was in fact just that.

“We received a letter in the mail saying ‘You’ve been reassessed and you owe us $560,” says Holly.

The couple was never told why they were being reassessed.

The Canada Revenue Agency says only that they typically reassess those who have an irregularity in their returns, as well as some Canadians chosen at random.

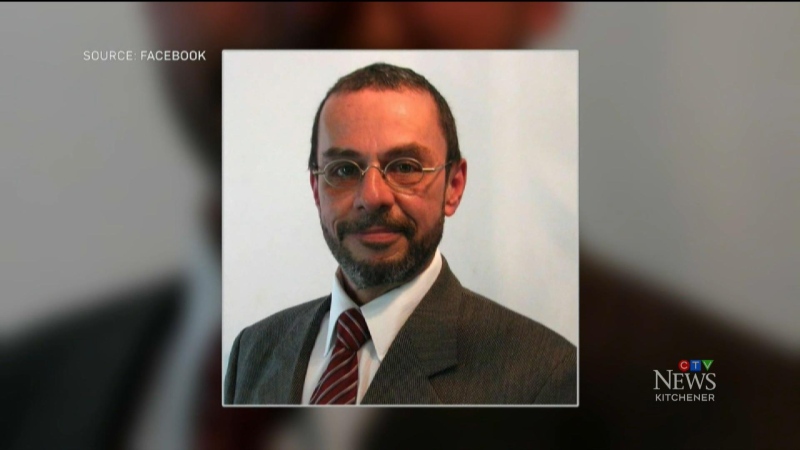

“Definitely there are some random selections, but we also look at what are some common areas where people tend to exaggerate the claim,” says agency spokesperson Sam Popadopoulos.

The Millers say they’ll pay the bill reluctantly, and if they find themselves in a similar situation in the future, won’t cash any unexpected tax bonuses.

“That way they can’t take it from us later,” says Holly.

Accountants and financial journalists offer several suggestions for avoiding reassessment. They include:

- Ensuring only one parent is claiming a child in a shared custody situation as a dependent

- Not claiming any health expenses paid for by insurance

- Only claiming moving expenses if moving at least 40 kilometres closer to workplace

Part 2: Credits and deductions can help lower tax bill

Most people don’t like filling out annual tax forms, and many try to make the process as quick as possible.

But for those thinking they’re making the process as painless as possible, speeding through taxes can actually lead to a hit square in the pocketbook.

There are a number of tax deductions out there than can save you money if you’ve done things like buy a home or enrolled your children in arts and sports programs.

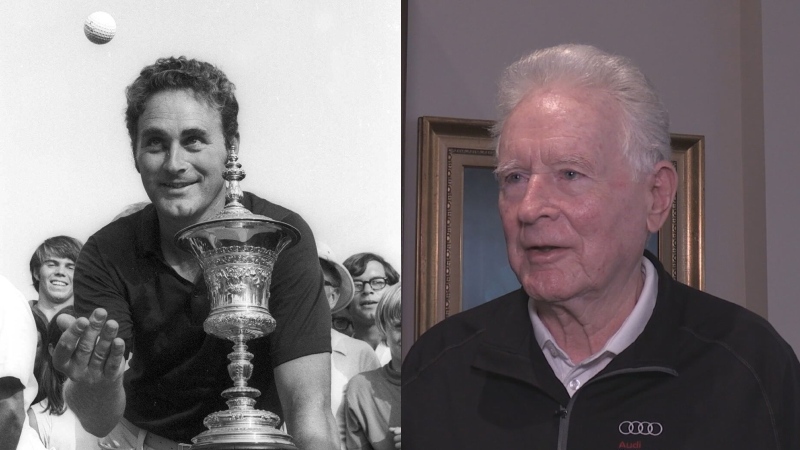

“Actually step back for a moment and think ‘Wait a minute, where do I spend money?’ Is there some type of tax deduction or credit for that?” suggests chartered accountant George Dube.

Credits are also available for anyone who makes an RRSP contribution – as long as it’s done before the end of February.

Similar to an RRSP is a registered disability savings plans.

Waterloo mother Amanda Bell is hoping to start putting money into a disability savings plan. She’s wanted to for some time, but with three children with autism, extra money is rarely available.

“When you do end up finding out about these things, sometimes you’re not able to financially get on board with it right away,” she says.

“You have to deal with debt or other things that come first.”

Claiming medical expenses on tax forms has the potential to net you a lot of money – but only if filed correctly. Otherwise, improper medical claims could trigger a reassessment.

“Particularly if there’s a larger or unusual expense,” says Dube.

“Perhaps the kids have some braces that are being put on or there was some eye surgery.”

Some financial experts say a good way to maximize tax returns is to discuss finances as a couple.

“Look for ways to pool investments and pool your charitable donations, and pool your medical expenses,” says financial commentator Pattie Lovett-Reid.

Some useful but often overlooked tax credits include:

- A credit of up to $75 per child for children enrolled in arts and sports programs

- A credit of up to $2,000 for a single parent sending a child to daycare

- A credit of $750 for a first-time homebuyer

Part 3: Different tax programs offer different levels of assistance

As of this year, the percentage of Canadians choosing to file their own taxes online stands at more than two-thirds – and growing fast.

But not all tax software is created equal.

There are more than 30 different Canadian tax programs to choose from. They range from cheaper options that can help you with a “just the basics” form to more intensive – and expensive – pieces of software.

One Kitchener accountant says people with different tax situations will require different levels of software.

“If you don’t have any additional things like deductions, employment expenses, business expenses or rental income, then just the basic off-the-shelf version will help,” Dean Paley tells CTV.

According to Paley, increased cost doesn’t just mean the software will catch more – you’re also paying for things like flashy graphics, as opposed to the numbers and boxes of most cheaper software.

To see which software provides the most bang for the buck, CTV set up three students at Kitchener’s St. Mary’s High School with two different tax programs and a set of basic tax forms for income, investments and tuition.

Meghan McKenna and Stephen Rickert were given TurboTax, a middle-of-the-road option with a graphical-based approach to completing the tax process.

Christina Voll was told to try U-File, a less expensive kit with a plain user interface.

All three are in their school’s specialized business program, but none of them had any experience with taxes prior to this experiment.

After about 20 minutes, McKenna was nearly done her return, with Rickert not far behind.

Voll hadn’t made it nearly as far in the process, which she attributes to her software.

“It was just very plain, type in your information and that’s about it,” she said.

“There’s no graphics or anything.”

McKenna agreed that the graphical elements of TurboTax made the process easier.

“The graphics were very interesting and they were very encouraging along the way, always telling me ‘Congratulations, you’re halfway there,” she said.

Although the graphical elements of TurboTax made it the preferred option of the students – Rickert also said he’d spend extra money for it – Paley says there’s nothing wrong with the cheaper, more basic options.

“FutureTax (is) about $6 for a basic return and it handles most situations,” he says.

“The other one would be StudioTax, which is free software. Just download it, and it can also handle most situations.”

This marks the first year the Canada Revenue Agency isn’t sending tax books in the mail.

With more and more people ignoring the books in favour of software, the agency says it’s no longer cost-efficient to mail out the books to people who have no intention of using them.