As of this year, the percentage of Canadians choosing to file their own taxes online stands at more than two-thirds – and growing fast.

But not all tax software is created equal.

There are more than 30 different Canadian tax programs to choose from. They range from cheaper options that can help you with a “just the basics” form to more intensive – and expensive – pieces of software.

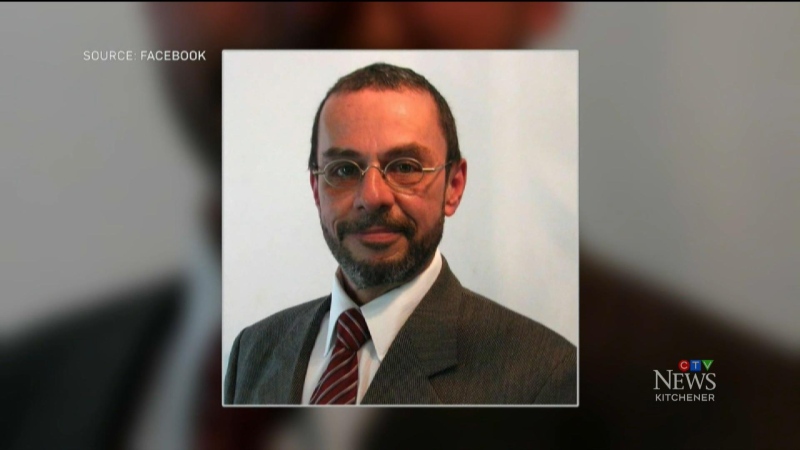

One Kitchener accountant says people with different tax situations will require different levels of software.

“If you don’t have any additional things like deductions, employment expenses, business expenses or rental income, then just the basic off-the-shelf version will help,” Dean Paley tells CTV.

According to Paley, increased cost doesn’t just mean the software will catch more – you’re also paying for things like flashy graphics, as opposed to the numbers and boxes of most cheaper software.

To see which software provides the most bang for the buck, CTV set up three students at Kitchener’s St. Mary’s High School with two different tax programs and a set of basic tax forms for income, investments and tuition.

Meghan McKenna and Stephen Rickert were given TurboTax, a middle-of-the-road option with a graphical-based approach to completing the tax process.

Christina Voll was told to try U-File, a less expensive kit with a plain user interface.

All three are in their school’s specialized business program, but none of them had any experience with taxes prior to this experiment.

After about 20 minutes, McKenna was nearly done her return, with Rickert not far behind.

Voll hadn’t made it nearly as far in the process, which she attributes to her software.

“It was just very plain, type in your information and that’s about it,” she said.

“There’s no graphics or anything.”

McKenna agreed that the graphical elements of TurboTax made the process easier.

“The graphics were very interesting and they were very encouraging along the way, always telling me ‘Congratulations, you’re halfway there,” she said.

Although the graphical elements of TurboTax made it the preferred option of the students – Rickert also said he’d spend extra money for it – Paley says there’s nothing wrong with the cheaper, more basic options.

“FutureTax (is) about $6 for a basic return and it handles most situations,” he says.

“The other one would be StudioTax, which is free tax software. Just download it, and it can also handle most situations.”

This marks the first year the Canada Revenue Agency isn’t sending tax books in the mail.

With more and more people ignoring the books in favour of software, the agency says it’s no longer cost-efficient to mail out the books to people who have no intention of using them.