Most people don’t like filling out annual tax forms, and many try to make the process as quick as possible.

But for those thinking they’re making the process as painless as possible, speeding through taxes can actually lead to a hit square in the pocketbook.

There are a number of tax deductions out there than can save you money if you’ve done things like buy a home or enrolled your children in arts and sports programs.

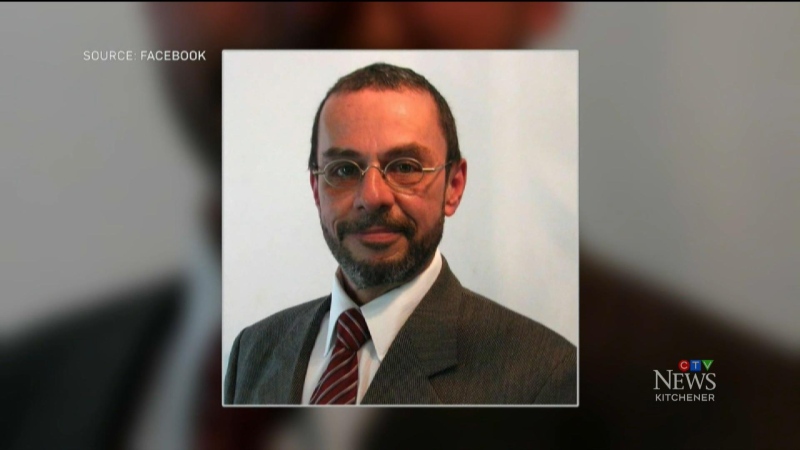

“Step back for a moment and think ‘Wait a minute, where do I spend money?’ Is there some type of tax deduction or credit for that?” suggests chartered accountant George Dube.

Credits are also available for anyone who makes an RRSP contribution – as long as it’s done before the end of February.

Similar to an RRSP is a registered disability savings plans.

Waterloo mother Amanda Bell is hoping to start putting money into a disability savings plan. She’s wanted to for some time, but with three children with autism, extra money is rarely available.

“When you do end up finding out about these things, sometimes you’re not able to financially get on board with it right away,” she says.

“You have debt or other things that come first.”

Claiming medical expenses on tax forms has the potential to net you a lot of money – but only if filed correctly. Otherwise, improper medical claims could trigger a reassessment.

“Particularly if there’s a larger or unusual expense,” says Dube.

“Perhaps the kids have some braces that are being put on or there was some eye surgery.”

Some financial experts say a good way to maximize tax returns is to discuss finances as a couple.

“Look for ways to pool investments and pool your charitable donations, and pool your medical expenses, because when you do that, the family lowers its tax bill” says financial commentator Pattie Lovett-Reid.

Some useful but often overlooked tax credits include:

- A credit of up to $75 per child for children enrolled in arts and sports programs

- A credit of up to $2,000 for a single parent sending a child to daycare

- A credit of $750 for a first-time homebuyer