For many people, declaring bankruptcy is an absolute last resort when dealing with debt.

It’s thought of as a tool for big companies, not one that can be used by the average person.

But while declaring bankruptcy is something that should be done with caution, as it sends credit ratings plummeting, financial experts say it’s not something that should be avoided in all cases.

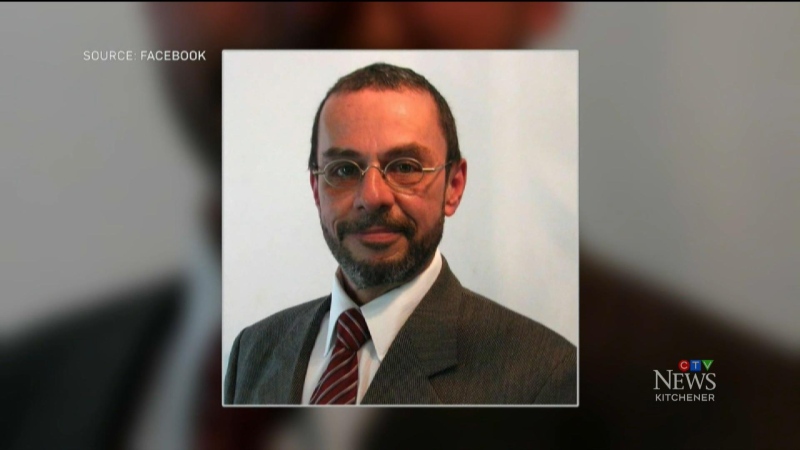

“We don’t want to talk about that up front if it’s not necessary, because it’s certainly going to harm your credit,” says bankruptcy trustee Doug Hoyes.

“You risk losing things like tax refund. And the more money you make, the more you’ve got to pay.”

Under the federal Bankruptcy and Insolvency Act, anyone owing $1,000 or more and without the assets to pay off those debts can declare bankruptcy.

Due to the drawbacks of doing so, though, those who file for bankruptcy generally have far greater debts.

“The average debt load is going to be $30,000 or $40,000 of credit cards, maybe a car loan, and a house mortgage payment in there,” says bankruptcy trustee Susan Taves of BDO Canada.

Filing for bankruptcy involves turning over complete control of financial arrangements to a bankruptcy trustee, who then sells off all the bankrupt individual’s assets, sending their credit rating down to R9 in the process.

“Of all the people who call us, only one in 10 ends up filing bankruptcy,” says Hoyes.

“The rest of them we either show other options or help them with a consumer proposal.”

Consumer proposals involve paying back a portion of what is owed to creditors over time, and not losing control of any assets, with the credit rating only falling to R7 in the process.

“The interest clock stops. It may take you longer to pay it back, but you may in fact be paying less,” says financial commentator Pattie Lovett-Reid.

Up to $250,000 in debt can be claimed in a consumer proposal. Hoyes says the recent raising of that limit from $75,000 has resulted in more customers choosing consumer proposals over bankruptcy.

“We’re doing more consumer proposals than we’re doing bankruptcies, which certainly wasn’t the case a few years ago,” he tells CTV.

That decrease in bankruptcies bucks the trend over the past quarter-century, during which the number of Canadians filing for bankruptcy rose significantly.

“Twenty-five years ago, there were maybe 100,000 filings in Canada. Now it’s been a steady climb for the last 20 years, to 140,000 filings a year in Canada,” says Taves.

Although Taves has handled high-profile local bankruptcy cases like Imagine Adoption and Pigeon King, she says it doesn’t lead her to think poorly of Waterloo Region’s economy.

“We have so many entrepreneurs, who are so active in the marketplace with positive economic activity,” she said.

“There’s always some pain out there, though.”