For many Canadians, mountains of debt present a difficult burden.

Often, people can find debt piling up so quickly that it becomes overwhelming, even though there are some simple steps that could be taken to help reduce the debt load.

For some people, developing and sticking to a budget is all it takes to slowly dig out of debt.

But for others, credit counsellors and other professionals are necessary to help sort out the financial picture and explain what should be done.

“We will look at your finances with you and help you try to develop a budget,” says credit counsellor Heather Cudmore.

Sometimes, people in debt try to take on a second job to help improve their cash flow.

But in some cases, especially when it comes to students, finding a job can be even more daunting than piles of debt.

Magda Beda is a business student and photographer. When she needed to find a way to keep pace with her $6,000-a-year tuition bill, she turned to uIntuition, a student-run service helping students looking for work connect with employers looking to temporarily hire young employees.

“I signed up about half a year ago, and since then I’ve probably made upwards of $5,000,” Beda tells CTV.

Not everyone struggling with debt gives it as much thought as Beda. A poll from Edward Jones Investments shows that one-third of people surveyed say they only keep track of fixed expenses like mortgages and car payments, while another third don’t keep track of their expenses at all.

Cudmore says that’s another way credit counsellors can help those needing a bit of financial guidance. They can also help settle debts.

“You can pay us and we pay fees to the creditors,” says Cudmore.

But if settling accounts isn’t desirable, consolidating several smaller loans into one big loan is another idea to consider.

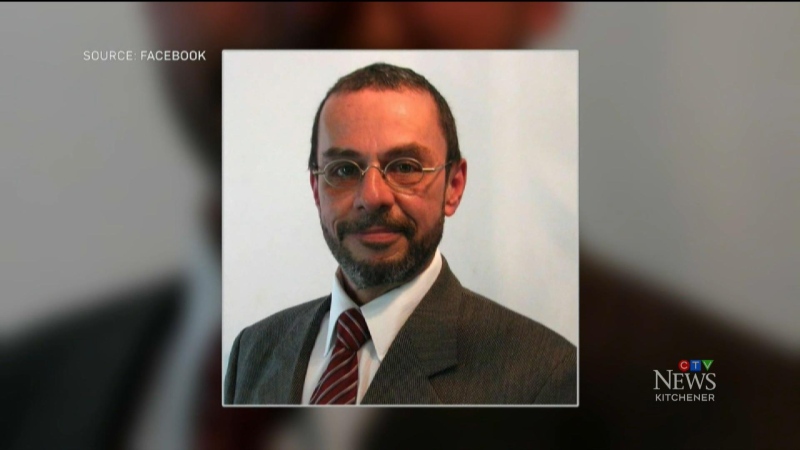

“By taking a high-interest credit card and rolling it into a lower-interest line of credit, more of your payments each month are going to principle,” says bankruptcy trustee Doug Hoyes.

In either case, though, consolidating or settling debts does follow your financial profile around, as your credit rating will be lowered to just one step shy of risking repossession.